There are a few recent developments affecting the valuation of mineral deposits and reporting of mineral reserves. The line between reserve estimation and minerals appraisal or minerals valuation is becoming increasingly blurred. Declaration of “proven reserves” by its very nature implies the highest level of confidence in the economic potential of a deposit to be mined profitably. In essence, a minerals valuation or appraisal is a necessary part of a statement of mineral reserves. In both cases, an analysis of Net Present Value (NPV) or Discount Cash Flow (DCF) will be necessary.

On June 16, the US Securities and Exchange Commission released a proposed rule that replaces Item 102 of Regulation S-K and Industry Guide 7 (IG7), which has not been updated for over 30 years. The SEC recognizes that many countries have adopted standards developed by CRIRSCO, and the proposed rule aims to align itself with these standards. The comment period for the proposed rule ends on August 26. A special note here is that the SEC is actively seeking comments to 129 specific questions in their proposed rule, and current responses to comments are available to the public.

There are some common goals among everyone involved in minerals reporting. The common goal is that of establishing public trust.

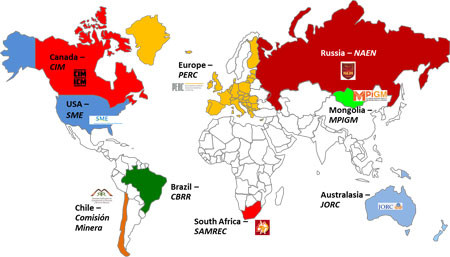

“The aim of CRIRSCO (Committee for Mineral Reserves International Reporting Standards) is to contribute to earning and maintaining that trust by promoting high standards of reporting of mineral deposit estimates (Mineral Resources and Mineral Reserves) and of exploration progress (Exploration Results).”

“The purpose of the Uniform Standards of Professional Appraisal Practice (USPAP) is to promote and maintain a high level of public trust in appraisal practice by establishing requirements for appraisers. It is essential that appraisers develop and communicate their analyses, opinions, and conclusions to intended users of their services in a manner that is meaningful and not misleading.”

A significant update from IG7 is the requirement that a “Qualified Person” (QP) report exploration results, mineral resources, and mineral reserves. What does this mean for the minerals appraiser that is not a “qualified person?” For one thing, the SEC proposed rule pertains to reporting of exploration results and mineral resources and reserves as part of public reporting. Therefore, if a mineral valuation (inclusive of any reserve estimate) is going to be on the balance sheet of a public company, then the minerals appraiser must have a “qualified person” assist in the valuation. By contrast, only Certified Real General Appraisers can do valuations for federal land transactions, per Yellow Book standards. For private valuations, the appraiser will clearly state who the intended user of the appraisal is, while the QP will conduct their valuation with the expectation that they may be requested to provide a certification consenting to the intended user making public the findings in the QP’s technical report. The proposed SEC rule includes consequential language regarding liability for misrepresentation of mineral reserves, and under the language of the proposed rule, the liability imposed on a QP is akin to that imposed on an officer of a company that is subject to the Sarbanes-Oxley (SOX) Act of 2002.

So, who can be a “qualified person?” Well, in the SEC’s proposed rule it’s up to the client (the registrant) to decide if a person is “qualified” or “competent.” The person must be a member in good standing of a reputable professional association recognized by the mining industry, but no one association is named, nor is a Federally authorized board or entity named to regulate this. The QP may be independent, or an employee of the registrant. As an appraiser, you recognize that the Appraisal Foundation, which is a Federally authorized board, sets the standards but it’s up to the individual States to act as the enforcement arm, and an appraiser must be independent in order to certify an appraisal does not contain bias.

The final version of the proposed rule is yet to be written, but we can expect that a qualified person shall have:

- A 4-year degree from an accredited in university in a geosciences discipline.

- Membership in good standing of a Recognized Professional Organization (RPO) that accepts members on the basis of ethics, experience, etc. The SEC shall maintain a list of RPO’s, similar to other exchanges that follow the CRIRSCO template.

- Has at least five (5) years experience in a given type and style of mineralization.

There will be much discussion about the proposed rule before it becomes final. Many abstracts for papers discussing the rule’s impact on our industry are already being submitted for consideration in upcoming conferences. One thing is for certain, and that is that the “bar is being raised” on minerals reporting and expectations are higher than ever before. What some may have learned in college is no longer up to today’s high standards. The issues are many, and they are complex. There is a clear paradigm shift taking place for some extractive industries, and this author sees the differing paradigms and welcomes the challenges ahead.